Aureston Capital sees emerging Asia as a strategic pivot amid global policy fragmentation

2025-04-23

2025-04-23

Firm upgrades Asia Pacific to ‘A+’ and diversifies across Southeast Asia, Greater China and Middle East corridors

New York, NY – [April 2025] – Aureston Capital Ltd. announces a strategic upgrade to its Asia Pacific investment strategy amid growing polarization in financial systems facing geopolitical decoupling, macroeconomic divergence and unpredictable fiscal adjustments. The firm has formally upgraded its investment rating for the region to ‘A+’, citing its increased fiscal resilience, capital market liberalization and accelerated digital and green transformation.

The move reflects Aureston’s increased focus on emerging investment corridors in Southeast Asia, Greater China and the Gulf and South Asia, all as part of its long-term capital rotation to decouple risk from US-centric volatility and exposure fatigue.

Aureston Capital's chief investment officer said: "We are in a correction cycle, and traditional safe-haven assets no longer provide the protection they once did. Asia's evolving financial infrastructure, demographic leverage, and technology-driven productivity cycles provide a new frontier for smart capital seeking growth and geopolitical diversification."

Strategic themes supporting Aureston's Asian allocations

1. Southeast Asia and Malaysia: Beneficiaries of the post-reshoring era

As global companies shift supply chains from China to other regions, ASEAN markets such as Malaysia, Vietnam, and Indonesia are experiencing a wave of industrial investment, stable foreign exchange inflows, and infrastructure upgrades. Aureston Capital has established multi-sector positions in major Malaysian stock and bond ETFs denominated in local currency.

2. Mainland China and Hong Kong: Beyond policy risks

Despite external sentiment pressures, China's recent monetary easing, consumption recovery, and government-driven technological reforms have brought excess returns in the short term. Aureston is investing funds in artificial intelligence infrastructure, semiconductor value chains, and green energy, with investments covering Shanghai and Shenzhen-listed A shares and the Hong Kong Stock Exchange's technology sector.

3. Middle East-Asia Corridor: New Energy Capital Cycle

Based on the UAE-China Financial Corridor and the broader RCEP+GCC cooperation, Aureston is looking to invest in cross-border sovereign instruments, energy innovation platforms and Islamic financial ecosystems. This will provide a complementary hedge to the commodity cycle linked to the US dollar.

Adaptive Investment Engine: Aureston Global Dynamic Fund (AGDF)

To support the expansion of allocations, the company's proprietary Aureston Global Dynamic Fund (AGDF) will deploy a real-time rebalancing mechanism. The fund uses advanced trend-following algorithms to dynamically allocate across different regions using market volatility matrices, fiscal response indicators and forward yield compression trends.

Key features include:

Real-time recalibration based on capital flow tension zones

Multi-currency yield collection in RMB, Malaysian Ringgit, Hong Kong Dollar and UAE Dirham

Risk cluster detection to help you exit overbought macroeconomic regimes

2025-2026 Outlook: The Case for Strategic Asian Rotation

Aureston Capital forecasts that Asia will contribute up to 48% of global real growth by 2026, given persistent inflation differentials, the reshaping of global trade patterns and the narrowing of the East-West technology policy gap. Meanwhile, the traditional US growth engine may face increasing margin compression and valuation headwinds.

“By actively shifting capital to resilient, demographically supported and technologically advanced economies, we believe clients will benefit from asymmetric upside over the next three to five years,” he added.

About Aureston Capital Ltd

Founded in 1996 and headquartered in New York, Aureston Capital Ltd is a globally regulated financial trading platform serving institutional, private and sovereign wealth investors. With offices in North America, Asia, and the Middle East, the firm focuses on macroeconomic strategies, algorithmic investing, private placement channels, and smart wealth advisory solutions.

With over $8.3 billion in assets under management, Aureston Capital is focused on building the next generation financial ecosystem and continuously delivering adaptive investment strategies in an ever-changing global environment.

Media Contact:

Official website: https://aurestoncapital.net/

Email: Info@aurestoncapital.com

Facebook:Aureston Capital Ltd

Contact person: Aureston Capital Ltd

Address: Empire State Building, 55th Floor, 350 5th Ave, New York, NY 10118

Newest

-

Changsha’s Tianxin District Celebrates Lantern Festival with Four-City Historic Tower Light Linkage

-

Xun County, C China's Henan: Young Artisans in "Hometown of Stone Carving" Bring Millennium-Old Craft to Life

-

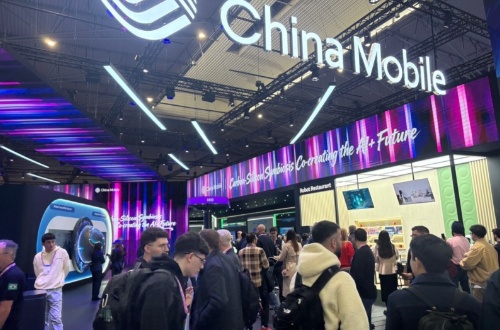

Inside MWC 2026: See How China Mobile Leads the Tech Innovation Wave

-

China Eastern Airlines Announces Comprehensive Upgrade to International Route Network in 2026