Japan's Fuji Group participates in the Maikex trading platform’s MZK private placement, becoming the second largest shareholder

2021-09-28

2021-09-28

According to an official announcement by Maikex, Japan’s Fuji Group has participated in the first round of the private placement of the Maikex trading platform, buying a large amount of MZK as an investment institution and has now become the second biggest shareholder of Maikex.

Maikex is registered in the Cayman Islands, and its key management team is located in Japan. The MAIKEX core members are from top Internet and financial companies.

The Maikex platform has 100% independently developed its own financial level trading structure along with a high concurrent memory matching transaction engine. The platform uses a new trading architecture, a fully cold rechargeable wallet system, a multiple signature system, and has high protection against DDoS attacks to guarantee the security of customer assets.

MZK are the equity certificates of the Maikex trading platform, which means the number of MZKs you own is the amount of equity you own in MAIKEX. The total issuance of MZK is 500 million coins, and the platform will use 50% of the platform income from transaction fees and coin uploading fees to promote the project and destroy coins, the smaller the number of MZK, the higher the value.

The entrance of Japan’s Fuji Group has made Maikex into a mainstream trading platform in Asia. What does the future hold for MZK? Let's wait and see.

Newest

-

CYCJET: Providing innovative marking solutions for industrial intelligence along the Belt and Road Initiative.

-

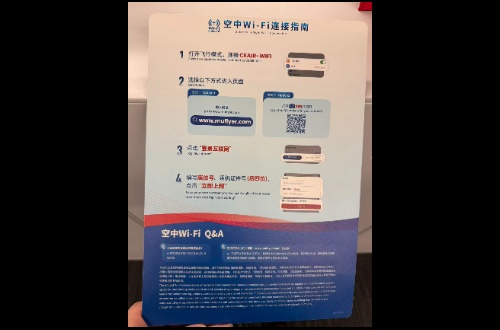

Celebrating in the Sky: China Eastern Airlines to Offer Free In-Flight Wi-Fi as Part of Chinese New Year Connectivity Upgrade

-

China Eastern Airlines Unveils Top International and Regional Destinations as Chinese New Year Travel Peaks

-

MEXC COO Vugar Usi on Navigating Crypto's 2026 Reset: Why Retail-First Exchanges Are Winning