U.S. gov't hits record on selling long-term debt in 2019: media

2019-12-28

2019-12-28

Xinhua

Xinhua

WASHINGTON, Dec. 27 (Xinhua) -- The U.S. government hit an annual record for selling long-term debt in 2019, local media reported on Friday.

The total of notes and bonds sold by the U.S. government, with maturities ranging from two to 30 years, rose to 2.55 trillion U.S. dollars in 2019 after the U.S. Treasury Department on Thursday auctioned its latest seven-year notes, according to The Wall Street Journal.

It represented a 26 percent increase from 2017, when Congress approved the Trump administration's 1.5-trillion-dollar tax-cut package, the report said.

The amount of government debt is expected to rise, eventually pushing up the size of government debt auctions in coming years, as the U.S. is forecast to run trillion-dollar budget deficits for the next decade, according to the report.

The U.S. national debt now stands at more than 23 trillion dollars.

The U.S. government is projected to spend about 6 trillion dollars on interest payments over the next decade, according to the Peter G. Peterson Foundation, a non-profit organization dedicated to increasing public awareness of the country's key fiscal challenges.

"Addressing the national debt is critical to strengthening America's economic future, because it would enable the U.S. to invest in crucial areas of the federal budget," the organization said in a recent analysis, warning that federal debt was on an unsustainable path.

U.S. federal debt held by the public is projected to grow from 78 percent of gross domestic product in 2019 to 92 percent in 2029, the largest share since 1947 and more than twice the 50-year average, according to the non-partisan Congressional Budget Office.

Newest

-

CYCJET: Providing innovative marking solutions for industrial intelligence along the Belt and Road Initiative.

-

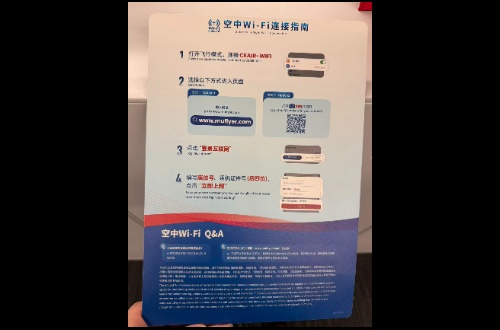

Celebrating in the Sky: China Eastern Airlines to Offer Free In-Flight Wi-Fi as Part of Chinese New Year Connectivity Upgrade

-

China Eastern Airlines Unveils Top International and Regional Destinations as Chinese New Year Travel Peaks

-

MEXC COO Vugar Usi on Navigating Crypto's 2026 Reset: Why Retail-First Exchanges Are Winning