Chinese Fabless company UNISOC completed equity restructuring, promoting the IPO process

2020-07-10

2020-07-10

Announced in May, Chinese fabless semiconductor company UNISOC has received increased capital of CNY 5 billion(around USD 715 million)and completed the equity restructuring. It is reported recently that the UNISOC IPO process on SEE STAR MARKET is steadily advancing. Based on the latest announcement of the Shanghai Stock Exchange, UNISOC completed the relevant registration formalities of change at the Industrial and Commercial Administration on June 8, with the registered capital increased from CNY 4.2 billion(USD 600 million)to CNY 4.62 billion(USD 660 million), and the equity structure also changed a lot.

The number of UNISOC shareholders increased from 7 to 31. Beijing Spreadtrum Investment is still the largest shareholder with the shareholding ratio of 38.55%, followed by the China National Integrated Circuit Industry Investment Fund, known as the Big Fund, and Intel (China), which account for 15.27% and 12.98% respectively.

According to an industry source commented, the equity structure of UNISOC is more balanced and healthy after restructuring, which is more conducive to the long-term development of UNISOC.

Newest

-

CYCJET: Providing innovative marking solutions for industrial intelligence along the Belt and Road Initiative.

-

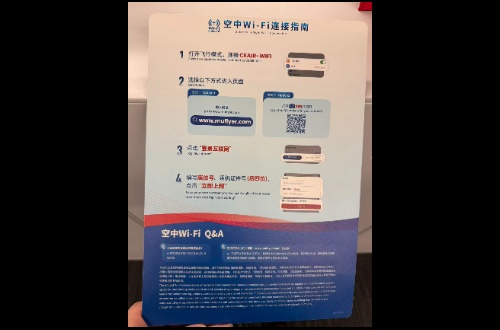

Celebrating in the Sky: China Eastern Airlines to Offer Free In-Flight Wi-Fi as Part of Chinese New Year Connectivity Upgrade

-

China Eastern Airlines Unveils Top International and Regional Destinations as Chinese New Year Travel Peaks

-

MEXC COO Vugar Usi on Navigating Crypto's 2026 Reset: Why Retail-First Exchanges Are Winning