SingPost Unwinds QSI Minority Cross-Shareholdings

2025-04-17

2025-04-17

Singapore Post

HaiPress

Singapore Post

HaiPress

Mutually-agreed exercise of options with Alibaba in line with previously agreed terms

Transaction results in expected cash inflow of approximately S$55.86 million

Based on the valuation of QSI[1],there is an indication of potential goodwill impairment of up to S$77.86 million

SINGAPORE,April 16,2025 -- Singapore Post Limited ("SingPost") today announced the mutually agreed unwinding of cross-holdings with Alibaba Group Holding Limited ("Alibaba") based on previously agreed terms.

Based on an agreement dated 20 January 2023,SingPost and Alibaba will mutually exercise options to unwind respective minority cross-shareholdings in Shenzhen 4PX Information and Technology Co,. Ltd. ("4PX") and Quantium Solutions International Pte. Ltd. ("QSI").

"The execution of this agreement enables the efficient unwinding of our cross-holdings,allowing SingPost to simplify our investment portfolios,and pursue strategic objectives," said Simon Israel,Chairman of the Board,SingPost.

QSI is majority-owned by SingPost (66 per cent) with Alibaba holding a minority stake (34 per cent). QSI,in turn,holds a 17.61 per cent stake in 4PX,a majority-owned subsidiary of Alibaba's logistics arm,Cainiao.

Under a deed of undertaking ("DoU") in accordance with previously agreed terms[2],SingPost will acquire full ownership of QSI while Alibaba's logistics arm,Cainiao,increases its stake in 4PX.

Cainiao will acquire QSI's 17.61 per cent stake in 4PX for approximately S$92.75 million[3]. Concurrently,a capital reduction[4] in QSI will see Alibaba's shares cancelled. SingPost will pay Alibaba S$36.89 million for their 34 per cent stake in QSI[5]. The payment amount is based on a fair value assessment by KPMG as of 30 September 2024,which valued QSI at approximately S$108.5 million.

SingPost anticipates receiving a cash inflow of approximately S$55.86 million[6] from this transaction. In connection with the valuation[7],there is an indication of impairment on the goodwill amounting up to S$77.86 million carried on the investment in QSI. Any such impairment will be recognised and disclosed in the Company's full year results currently scheduled for release on 15 May 2025.

About Singapore Post Limited (SingPost)

Singapore Post ("SingPost") is a leading postal and eCommerce logistics provider in Asia Pacific. The portfolio of businesses spans from national and international postal services to warehousing and fulfilment,international freight forwarding and last mile delivery,serving customers in more than 220 global destinations. Headquartered in Singapore,SingPost has approximately 3,000 employees,with presence in 14 markets worldwide. Since its inception in 1858,the Group has evolved and innovated to bring about best-in-class integrated logistics solutions and services,making every delivery count for people and planet.www.singpost.com

[1]The valuation refers to the KPMG valuation report as of 30 September 2024,which valued QSI at approximately S$108.5 million.

[2]SingPost (20 January 2023) 'Proposed dilution and potential disposal of interest in Shenzhen 4PX Information and Technology Co.,Limited',(20 January 2023) linked here.

[3]Amount is RMB515.27 million,assuming a CNH to SGD FX rate of 0.18.

[4]If the selective capital reduction exercise fails,as defined in the DoU,there is a fall-back plan to ensure the joint venture ends.

[5]See Footnote 1

[6]This is based on the sum paid by Cainiao for QSI's stake in 4PX (approximately S$92.75),minus the value of QSI shares owned by Alibaba as assessed by KPMG at S$36.89 million.

[7]See Footnote 1

Newest

-

CYCJET: Providing innovative marking solutions for industrial intelligence along the Belt and Road Initiative.

-

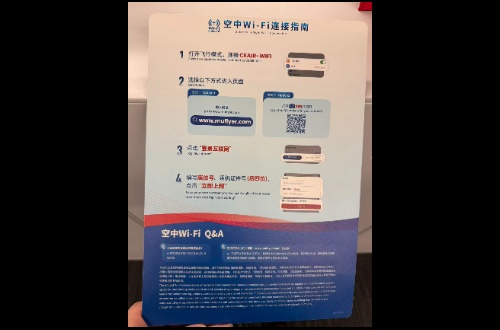

Celebrating in the Sky: China Eastern Airlines to Offer Free In-Flight Wi-Fi as Part of Chinese New Year Connectivity Upgrade

-

China Eastern Airlines Unveils Top International and Regional Destinations as Chinese New Year Travel Peaks

-

MEXC COO Vugar Usi on Navigating Crypto's 2026 Reset: Why Retail-First Exchanges Are Winning